Markets sold off around the globe, as news that the coronavirus, also known as COVID-19, has spread to South Korea, Italy, Japan, and Iran. Many European markets closed down more than 4%. While the U.S. stock markets sold off hard as well, with the S&P 500 Index down 3.35% and the Dow Jones Industrial Average lost 1,031 points by the end of trading on Monday.

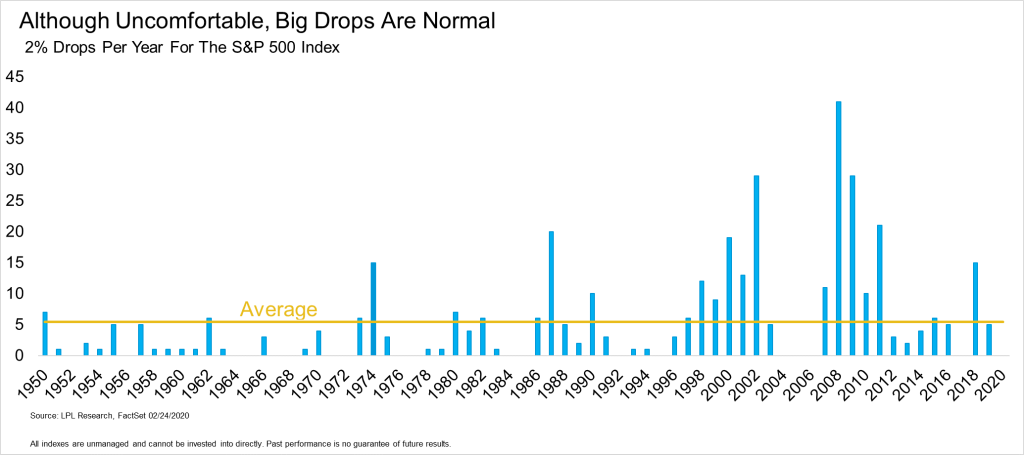

“Although the fear over the pandemic is real, and the potential slowdown in the global economy could hurt 2020 corporate profits, let’s not forget that big down days are part of what long-term investors have had to accept,” said LPL Financial Senior Market Strategist Ryan Detrick.

As shown in the chart below, an average year has more than five separate days with at least a 2% correction for the S&P 500 Index. Even last year, with stocks up 30%, there were five separate days that saw the S&P 500 close down at least 2%.

The United States had held up relatively well in the face of the growing COVID-19 crisis. In fact, according to Sam Stovall of CFRA, the S&P 500 actually gained 1.6% a month after the first reported coronavirus case in the United States on January 21. As the chart below shows, stock market gains historically have been normal after the initial outbreak of various health crises have reached the United States.

Now, could the coronavirus impact the global economy more than previous epidemics and pandemics? That’s clearly a strong possibility, as global supply chains have come to a halt in the world’s second largest economy (China). The good news, though, is corporate America just reported a very impressive earnings season. The bad news is that this might change in the near future.

Lastly, we’d like to stress that pullbacks and market corrections happen and are part of long-term investing. In fact, since 1980 the average year has experienced a pullback from peak to trough of 13.7%. Even more impressive: Looking at the 29 years that stocks have been green since 1980, we see the average year had a correction of 10.9%!

We’ll continue to monitor the impact of the coronavirus situation very closely. In the meantime, we would suggest that long-term investors consider staying the course and possibly use this volatility as an opportunity to rebalance your portfolio or add to positions that have recently come down in value.

Disclosure: This website is solely for informational purposes. Nothing on this website should be considered as advice, research or an invitation to buy or sell securities.